Introduction

Let’s be honest—buying car insurance isn’t exactly the most exciting thing to do. But it’s something we all need, and finding the right balance between affordability and solid coverage can be a real headache. That’s where Reliance Car Insurance Online comes in, offering a quick, transparent, and fully digital way to protect your car without burning a hole in your wallet.

Gone are the days of waiting for paperwork, dealing with confusing policies, or struggling with endless calls to insurance agents. Reliance Car Insurance Online simplifies the whole process, making it easier for drivers to get the protection they need—without the fuss.

Why Drivers Love Reliance Car Insurance Online

Insurance That’s Built for Today’s Fast-Paced World

Who has time to visit insurance offices or fill out endless forms? Reliance Car Insurance Online is designed for speed, simplicity, and reliability, giving you the coverage you need in minutes.

Customizable Policies to Fit Your Needs

Not all car owners have the same requirements. With Reliance Car Insurance Online, you can tweak your coverage, add extra protection, and adjust premiums—all with just a few clicks.

No More Paperwork or Long Processing Times

Everything is digital! Need to downl*ad your policy? File a claim? Renew your coverage? You can do it without touching a single sheet of paper.

And with a 98% customer satisfaction rate, it’s clear that Reliance Car Insurance Online is making waves in the insurance industry.

How Reliance Car Insurance Online Gives You the Edge

1. Easy Policy Management

With a simple online dashboard, policyholders get full control over their insurance—no phone calls, no paperwork, no waiting.

- 24/7 Access – Log in anytime to review details, track claims, or downl*ad documents.

- Auto-Renewal Reminders – Never miss a renewal deadline with handy email and SMS alerts.

- Instant Add-Ons – Want more coverage? Add zero depreciation, key replacement, or engine protection in seconds.

2. Quick and Smooth Claims

Nobody likes dealing with insurance claims, but Reliance Car Insurance Online has made it as smooth as possible.

- One-Touch Claim Registration – Just upload accident details with photos via the app—no complicated forms.

- AI-Powered Damage Assessment – Claims are approved within 24 hours for straightforward cases.

- Fast Payouts – No waiting for cheque clearances—settlements are sent directly to your bank in 48 hours.

With claims processing this fast, drivers can get back on the road in no time.

Affordable Car Insurance That Doesn’t Cut Corners

Let’s debunk the myth—affordable insurance doesn’t have to mean less coverage! Here’s how Reliance Car Insurance Online ensures great protection at unbeatable prices:

- No-Claim Bonus (NCB) Discounts – Save up to 50% on renewals for staying accident-less.

- Flexible Payment Options – Break your premium into monthly installments at zero interest.

- Exclusive Online Deals – Get 15–25% off compared to offline policies, thanks to no agent commissions.

A recent industry report revealed that users of Reliance Car Insurance Online save an average of ₹8,200 annually compared to traditional insurance providers.

Trust and Security: The Foundation of Reliance Car Insurance Online

With 20+ years of expertise behind it, Reliance Car Insurance Online ensures that every policyholder gets secure, trustworthy protection.

- Bank-Grade Encryption – Keeps your personal data safe and secure.

- IRDAI Compliance – Every policy follows strict industry regulations for fairness.

- Dedicated 24/7 Support – Get help via live chat, phone, or email—with responses in 15 minutes or less.

With over 1.5 million happy customers, it’s clear why drivers trust Reliance Car Insurance Online.

Keeping Up with Modern Mobility Trends

1. Electric Vehicle (EV) Coverage

Driving an EV? Reliance Car Insurance Online has specialized plans that cover:

- Battery replacement for manufacturer defects.

- Charging station damage due to power surges.

- Discounts for eco-friendly drivers who reduce their carbon footprint.

2. Smarter Insurance with Telematics

Want personalized pricing based on how you drive? Opt for usage-based insurance (UBI), which includes:

- Real-time driving analytics to monitor speed, braking, and efficiency.

- Monthly reports with feedback to improve driving habits—and lower premiums!

3. Global Travel Protection

For frequent travelers, Reliance Car Insurance Online offers international coverage across 150+ countries, ensuring peace of mind no matter where you go.

Reliance Car Insurance Online vs. Traditional Policies: A Clear Winner

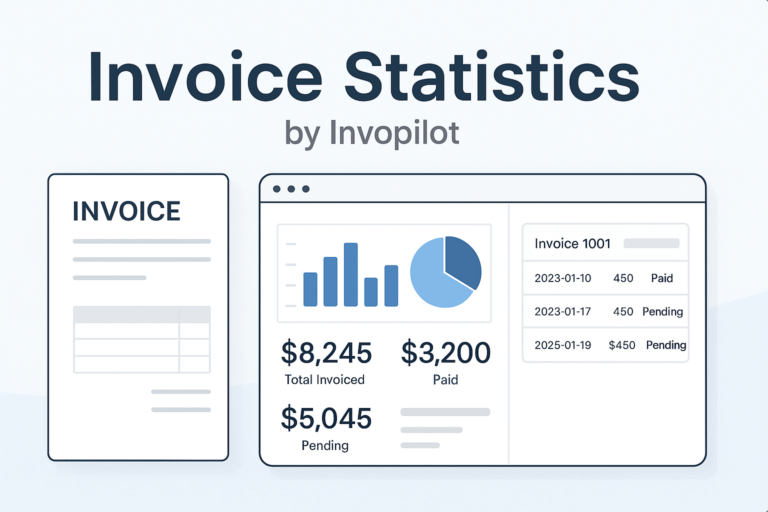

| Feature | Reliance Car Insurance Online | Traditional Insurance |

|---|---|---|

| Policy Purchase Time | 5–7 minutes | 2–3 business days |

| Claim Settlement Rate | 89% in 48 hours | 62% within 7 days |

| Add-On Flexibility | 12+ customizable options | Limited to 3–5 add-ons |

| Renewal Process | One-click automation | In-person documentation |

This side-by-side comparison makes it clear: Reliance Car Insurance Online is the smarter, faster, and more efficient choice.

Frequently Asked Questions

1. Can I switch my current car insurance to Reliance Car Insurance Online?

Yes! They offer a Smooth migration service with dedicated support to help you switch smoothly.

2. Does Reliance Car Insurance Online cover natural disasters?

Yes! Comprehensive plans include protection against floods, earthquakes, cyclones, and landslides.

3. How do I track my claim status?

Simply check updates in real-time through the mobile app or SMS notifications.

Final Thoughts

Reliance Car Insurance Online is changing the g*me by making auto insurance smarter, faster, and more accessible. No confusing paperwork, no frustrating claim delays—just straightforward protection that works for drivers, not against them.

If you’re looking for a cost-effective yet reliable way to insure your car, it’s time to switch to Reliance Car Insurance Online with Quickinsure where affordability meets comprehensive coverage.