Finding the right Health Insurance for the family is crucial for managing medical expenses. With rising healthcare costs, many people wonder whether a Health Insurance plan for the entire family or individual policies offer better savings.

Choosing the wrong plan can lead to higher premiums or insufficient coverage. The right decision depends on family size, age, and healthcare needs. Let’s break down each plan’s benefits, costs, and potential savings.

What is Individual Health Insurance?

An individual Health Insurance plan covers one person with a dedicated sum insured. Each family member needs a separate policy, ensuring they get exclusive coverage without sharing it with others.

Benefits of Individual Health Insurance

- Full coverage for each member – The sum insured is not shared, ensuring better financial security.

- No risk of claim exhaustion – Since each person has their policy, one member’s claim doesn’t reduce another’s coverage.

- Tailored coverage – Each member can cover specific health conditions and requirements separately.

Limitations of Individual Health Insurance

- Higher premiums – Insuring each family member separately increases overall costs.

- Complex policy management – Multiple renewal dates and paperwork can be overwhelming.

What is Family Health Insurance?

A Health Insurance for family plan covers all family members under a single policy. The sum insured is shared, meaning any member can use it as needed.

Benefits of Family Health Insurance

- Cost-effective – A single premium is usually lower than the combined cost of multiple individual plans.

- Easier to manage – One policy covers everyone, reducing paperwork and renewal hassles.

- Flexible coverage – The sum insured can be used by any member, making it ideal for unexpected medical needs.

Limitations of Family Health Insurance

- Coverage may get exhausted – If one member makes a large claim, less coverage remains for others.

- Premiums depend on the oldest member – Higher premiums apply if a senior citizen is included.

Cost Comparison: Which One Saves More?

Understanding the cost differences between a Health Insurance for family plan and individual policies is key to smart financial decisions. The right choice depends on premiums, claim scenarios, and overall affordability.

Premiums and Affordability

A Health Insurance plan for an individual generally has lower premiums. However, when covering multiple people, separate policies can become expensive. Family Floater Plans offer a more affordable option since a single premium covers all members.

For example, a Family Floater Plan with INR 5 Lakh sum insured may cost around INR 26,000 annually. Meanwhile, individual policies of INR 5 Lakh each for four members could cost around INR 35,000. The difference in cost highlights why family plans are often more budget-friendly.

Claim Scenarios

Family plans provide flexibility but can become risky if one member needs extensive treatment. If a major claim exhausts the insured sum, others may be left without coverage until renewal. Individual policies prevent this issue by ensuring each person has their insured sum.

Which Plan Is Best for Your Family?

Choosing between an individual and family Health Insurance plan depends on the specific needs of the insured members. Age, medical history, and financial considerations are crucial in determining the right policy.

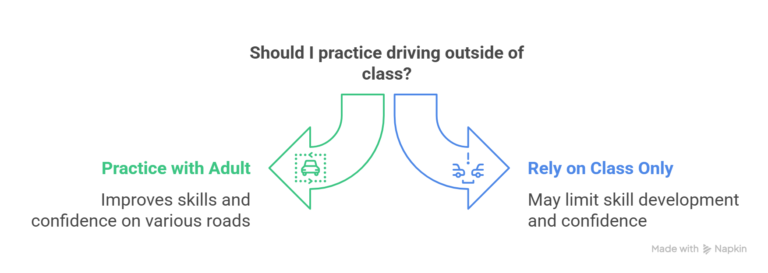

When to Choose an Individual Plan?

- If family members have different health risks and need personalised coverage.

- If there are elderly members who may require higher coverage.

- If affordability is not a concern, full coverage for each member is preferred.

When to Choose a Family Health Insurance Plan?

- If the family is young and generally healthy, with no major medical concerns.

- If a cost-effective solution is required to cover multiple members,

- If the goal is to have easy policy management with fewer renewals.

Feature | Individual Health Insurance | Family Health Insurance |

Coverage | Separate sum insured for each member | Shared sum insured among family members |

Premiums | Higher overall cost for multiple members | More cost-effective for families |

Claim Exhaustion Risk | No risk – each person has their coverage | Risk of sum insured getting used up by one member |

Policy Management | Multiple policies, renewals, and paperwork | Single policy, easier to manage |

Customisation | Tailored coverage for each individual | Common coverage for all members |

Best For | Elderly members or those with high medical needs | Young, healthy families looking for affordable coverage |

Conclusion

Choosing the right Health Insurance for a family depends on personal needs and financial considerations. Family plans are generally more affordable and convenient, but individual plans provide dedicated coverage for each person.

Before deciding, assessing health risks, budget, and future medical needs is important. Consulting with a trusted provider like Bajaj Allianz General Insurance Company can help determine the most suitable Health Insurance plan. Comparing options carefully ensures families get the best balance of cost and coverage.

*Standard T&C Apply

Insurance is the subject matter of solicitation. For more details on benefits, exclusions, limitations, terms, and conditions, please read the sales brochure/policy wording carefully before concluding a sale.