In today’s competitive business landscape, bookkeeping & accounting services in Miami, FL play a crucial role in helping businesses thrive. While bookkeeping may seem like a routine administrative task, it is actually the backbone of financial management. Effective bookkeeping not only ensures compliance with tax regulations but also provides insights that drive strategic business decisions. By keeping accurate financial records, businesses can streamline operations, improve cash flow, and make data-driven decisions for growth and expansion.

The Role of Bookkeeping in Business Success

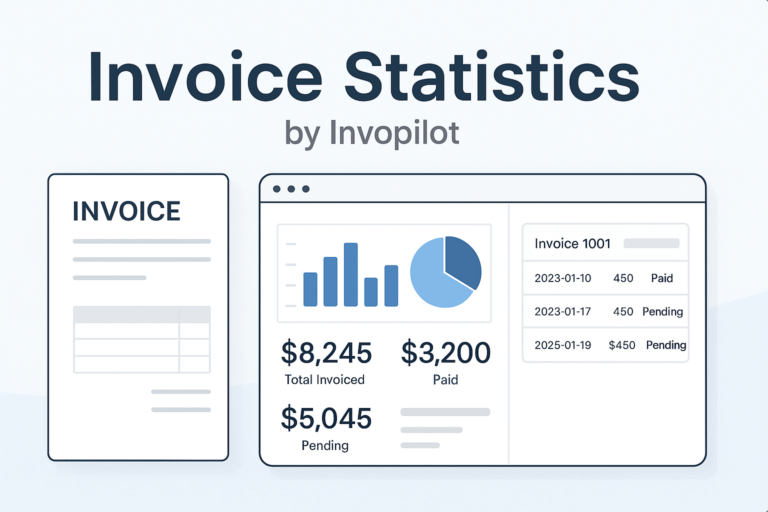

Bookkeeping is more than just recording transactions; it provides a comprehensive view of a business’s financial health. Understanding financial statements, tracking expenses, and managing invoices help businesses avoid financial pitfalls and seize growth opportunities. Here’s how bookkeeping contributes to business success:

1. Provides a Clear Financial Overview

Accurate bookkeeping ensures that business owners have a clear understanding of their financial standing. Well-maintained financial records help:

- Track income and expenses

- Identify profit trends

- Monitor outstanding invoices and liabilities

- Detect discrepancies early on

With a detailed financial overview, businesses can make informed decisions about investments, budgeting, and resource allocation.

2. Ensures Compliance with Tax Regulations

Tax compliance is a critical aspect of business operations. Poor record-keeping can lead to misfiled taxes, penalties, and audits. Proper bookkeeping helps businesses:

- Maintain accurate financial records for tax filing

- Deduct eligible business expenses

- Avoid late payment penalties

- Prepare for audits with well-documented records

By staying tax-compliant, businesses can avoid unnecessary financial setbacks and focus on growth.

3. Improves Cash Flow Management

Managing cash flow effectively is essential for business sustainability. Bookkeeping helps:

- Track revenue and expenses in real-time

- Identify slow-paying clients and overdue invoices

- Ensure timely payment of suppliers and creditors

- Plan for future financial obligations

A healthy cash flow ensures that businesses can cover operational costs, invest in expansion, and withstand economic downturns.

4. Helps in Budgeting and Financial Planning

A well-maintained bookkeeping system serves as a financial roadmap for businesses. It allows entrepreneurs to:

- Set realistic revenue and expense projections

- Allocate resources efficiently

- Plan for seasonal fluctuations

- Adjust financial strategies based on performance reports

With clear financial planning, businesses can set growth targets and work towards achieving them strategically.

5. Supports Business Expansion

Expanding a business requires a solid financial foundation. Bookkeeping provides the necessary financial data to:

- Secure loans and attract investors

- Assess the profitability of expansion plans

- Determine the financial feasibility of hiring new employees

- Invest in technology and infrastructure

Businesses with well-documented financial records have a higher chance of obtaining funding and successfully scaling their operations.

How Bookkeeping Enhances Business Efficiency

1. Reduces Financial Errors

Manual errors in financial records can lead to costly mistakes. A well-organized bookkeeping system minimizes errors by ensuring accurate data entry, reconciliation, and verification.

2. Streamlines Payroll Management

Managing payroll efficiently is crucial for maintaining employee satisfaction. Bookkeeping helps businesses:

- Calculate salaries and deductions accurately

- Ensure timely payroll processing

- Keep records for tax and legal compliance

An effective payroll system improves employee morale and enhances workplace productivity.

3. Enhances Decision-Making

With access to real-time financial data, business owners can make data-driven decisions. Whether it’s launching a new product, entering a new market, or optimizing operations, bookkeeping provides valuable insights for strategic planning.

4. Improves Vendor and Supplier Relationships

Timely payments to vendors and suppliers strengthen business relationships. Accurate bookkeeping ensures that businesses:

- Track outstanding payments

- Negotiate better payment terms

- Avoid late payment penalties

Strong supplier relationships contribute to business stability and long-term growth.

5. Facilitates Business Performance Analysis

Regular financial reports help businesses analyze their performance and identify areas for improvement. Business owners can:

- Compare financial data across different periods

- Identify trends in revenue and expenses

- Optimize cost management strategies

Analyzing financial performance helps businesses adapt to market changes and stay competitive.

The Role of Professional Bookkeeping & Accounting Services in Business Growth

1. Expertise and Accuracy

Professional bookkeepers have the expertise to handle complex financial records accurately. They ensure compliance with regulations and help businesses avoid financial mismanagement.

2. Saves Time and Resources

Outsourcing bookkeeping allows business owners to focus on core operations. It eliminates the need for in-house bookkeeping staff, reducing overhead costs and increasing efficiency.

3. Access to Advanced Financial Tools

Bookkeeping & accounting services in Miami, FL, leverage advanced accounting software and tools to:

- Automate financial processes

- Generate real-time financial reports

- Improve data security

Using cutting-edge technology ensures accuracy and efficiency in financial management.

4. Personalized Financial Advice

Professional bookkeepers offer tailored financial advice to help businesses:

- Optimize tax strategies

- Identify cost-saving opportunities

- Plan for long-term financial success

Having access to expert financial guidance helps businesses navigate challenges and seize growth opportunities.

5. Scalability and Flexibility

As businesses grow, their financial needs evolve. Professional bookkeeping services can scale their solutions to meet the changing demands of growing enterprises.

Conclusion

Bookkeeping & accounting services in Miami, FL play a fundamental role in business growth and expansion. From maintaining financial clarity to improving cash flow, ensuring tax compliance, and enabling strategic decision-making, bookkeeping provides the financial stability businesses need to thrive. Whether a business is a startup or an established enterprise, investing in professional bookkeeping services can unlock new growth opportunities and pave the way for long-term success.

At Greenlight Financial, we are committed to delivering tailored accounting solutions that empower small to medium-sized businesses with expert financial guidance. Our mission is to provide exceptional service while fostering strong, lasting client relationships for sustainable growth. We envision becoming a leading provider of innovative accounting solutions, recognized for our integrity, expertise, and client success. Guided by our core values—integrity, excellence, collaboration, and client focus—we ensure reliable, strategic, and results-driven solutions. By combining cutting-edge technology with personalized support, we help businesses navigate their financial journey with confidence, clarity, and long-term success.