In an era where vehicular safety and financial security are paramount, Kotak Car Insurance stands as a beacon of trust and reliability. Offering a suite of comprehensive coverage options, Kotak ensures that both individual and corporate clients receive unparalleled protection tailored to their unique needs.

Comprehensive Coverage Options

Kotak Car Insurance provides a range of policies designed to cater to diverse requirements:

- Third-Party Liability Insurance: Mandatory under Indian law, this policy covers legal liabilities arising from damages caused to third parties.

- Own Damage Cover: Protects against damages to your vehicle due to accidents, theft, natural calamities, and more.

- Comprehensive Car Insurance: A holistic policy combining both third-party liability and own damage cover, ensuring extensive protection.

These policies are further enhanced by a plethora of add-on covers, allowing policyholders to customize their insurance plans for optimal coverage.

Innovative Add-On Covers

To augment the standard policies, Kotak Car Insurance offers several add-on covers:

- Zero Depreciation Cover: Ensures full claim settlement without factoring in depreciation on replaced parts.

- Engine Protection Cover: Safeguards against non-accidental damages to the engine, especially beneficial in flood-prone areas.

- Return to Invoice Cover: In case of total loss or theft, this cover reimburses the original invoice value of the car.

- Consumables Cover: Covers the cost of consumables like engine oil, coolant, and brake fluid during repairs.

- Roadside Assistance: Provides 24/7 assistance for emergencies like towing, flat tires, or battery issues.

These add-ons empower policyholders to tailor their insurance plans, ensuring comprehensive protection against unforeseen events.

Seamless Claim Process

Kotak Car Insurance is renowned for its efficient and transparent claim settlement process:

- Claim Intimation: Policyholders can notify the company about a claim through various channels, including online portals and customer care.

- Document Submission: Essential documents like the claim form, vehicle registration certificate, driving license, and FIR (if applicable) are submitted.

- Survey and Assessment: A surveyor assesses the damages, post which the claim is processed.

- Claim Settlement: Depending on the policy terms, the claim is settled either through cashless facilities at network garages or via reimbursement.

With a vast network of over 4,200 cashless garages across India, policyholders can avail hassle-less repair services, ensuring minimal downtime.

Exclusive Benefits and Discounts

Kotak Car Insurance offers a range of benefits to enhance customer satisfaction:

- No Claim Bonus (NCB): Policyholders can avail discounts up to 50% on premiums for claim-less years.

- Multi-Car Discounts: Insuring multiple vehicles under a single policy can lead to substantial savings.

- AAI Membership Discount: Members of the Automobile Association of India are eligible for additional premium discounts.

- Premium Protection for High-Value Cars: Special features like agreed value coverage and zero depreciation ensure optimal protection for luxury vehicles.

These benefits underscore Kotak’s commitment to providing value-added services to its clientele.

Technological Advancements: The ‘Meter’ Add-On

Embracing innovation, Kotak Car Insurance introduces the ‘Meter’ add-on—a ‘pay-as-you-use’ feature allowing policyholders to switch their coverage on and off based on vehicle usage. This is particularly beneficial for individuals with limited car usage, offering up to 40% cashback or renewal discounts.

Customer-Centric Approach

Kotak Car Insurance places immense emphasis on customer satisfaction:

- 24/7 Customer Support: Dedicated helplines ensure prompt assistance for queries and claims.

- User-Friendly Online Portal: Policyholders can purchase, renew, and manage their policies seamlessly online.

- Transparent Policies: Clear terms and conditions ensure that customers are well-informed about their coverage.

This customer-centric approach fosters trust and long-term relationships.

Conclusion

Kotak Car Insurance emerges as a reliable partner for vehicle owners, offering comprehensive coverage, innovative add-ons, and a seamless claim process. With a focus on customer satisfaction and technological advancements, Kotak ensures that policyholders drive with confidence and peace of mind.

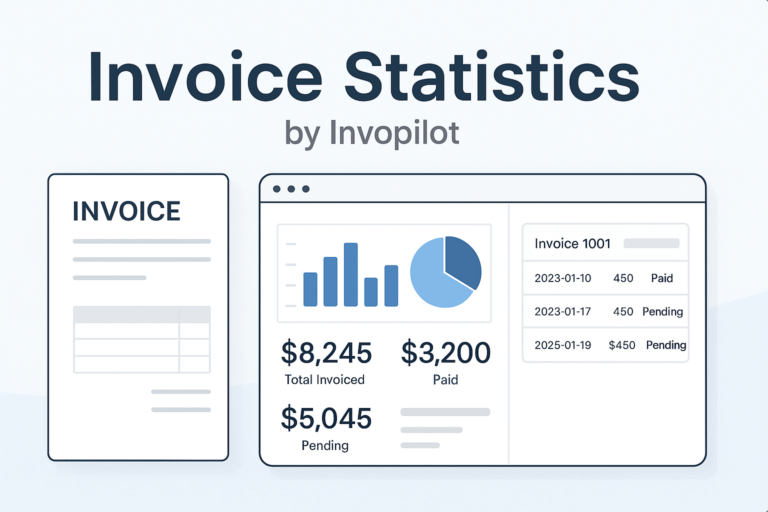

Secure Your Vehicle with Quickinsure

For a streamlined and efficient insurance experience, consider partnering with Quickinsure. Our platform offers a comparative analysis of various insurance policies, ensuring you select the best coverage tailored to your needs. With Quickinsure, you benefit from expert guidance, prompt customer support, and a hassle-less policy management system.