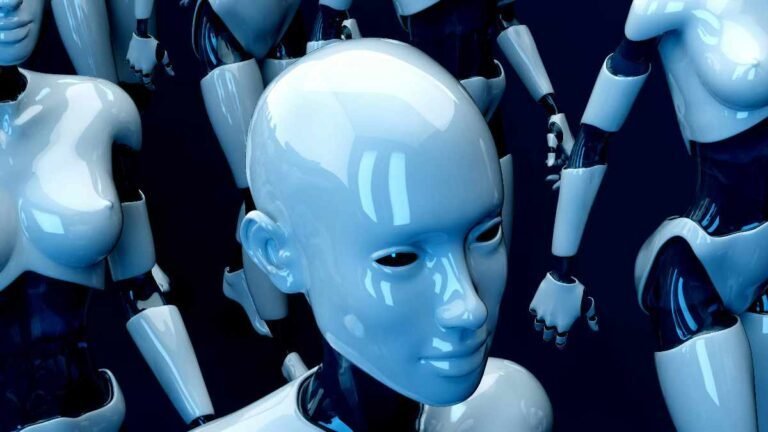

Financial modeling skills now involve artificial intelligence (AI) competencies. After all, AI can positively impact data quality assurance methods. It can also help overcome risk estimation hurdles. That is why AI integrations impress veteran investment bankers. Whether they want to estimate initial public offerings’ success or craft pitch decks, AI aids them accelerate the processes involved. This post will now describe how AI and modern data solutions assist in the valuation and risk assessment that investment banking stakeholders often require.

Replacing conventional workflows to achieve better efficiency, precision, and insights involves understanding how newer methods will improve core functions. Therefore, adequate skills can be learned to prepare for the future.

How AI and Data Solutions in Investment Banking Facilitate More Reliable Valuation

Investment bankers must precisely quantify assets’ worth like other financial professionals. Their valuation tasks can also focus on multiple companies or portfolios. Before the advent of automation and AI, valuation activities revolved around manual financial models. So, investment bankers used to spend hours, if not days, as they sought historical data and studied financial statements. However, today’s investment banking outsourcing has surpassed those methods in terms of speed and scale. Likewise, the reliability of their reporting has increased thanks to AI integrations dedicated to valuation.

AI algorithms allow an investment bank (IB) to examine structured and unstructured data at a greater scale. Furthermore, finding relevant insights can necessitate news tracking and sentiment analytics. As well-trained AI and machine learning models also excel at predictive analysis and social media monitoring, including data on stakeholder faith or online reputation for valuation improvements is also feasible.

Alternative data sources that AI-powered platforms can mine and transform also aid in examining how an asset might perform. As a result, investment bankers can correctly inspect valuation data based on changes in market conditions. They can help stakeholders utilize these findings during corporate deal negotiations for impartial mergers and acquisitions transactions.

The Role of AI and Data Solutions in Investment Banking for Risk Assessment Purposes

Major fluctuations in markets and regulations do not happen overnight. They might gather a lot of attention due to a few events, but many experts delivering data analytics consulting concerning similar trends warn stakeholders about those seismic market shocks early on. So, it must not surprise anyone that AI and data solutions are effectively enabling finance and investment banking professionals to prepare for volatile circumstances.

Risk assessment with AI increases the number of scenarios investment bankers can explore to address the limitations of businesses’ current assumptions and portfolio strategies. During business mergers and acquisitions (M&A), risk identification will consider whether acquirers will have unreasonably increased liabilities due to inefficiencies in the target firms.

In the case of initial public offerings (IPOs), undersubscription risks weaken the leaders’ confidence in meeting the fundraising requirements. So, asking investment banks to help mitigate them is essential. However, IBs must not use empirical wisdom to deliver market-making assistance for IPO success. Instead, they can leverage AI optimized to uncover solid insights into IPO undersubscription possibilities.

Examples: Relying on AI and Data Solutions to Improve Investment Banking Practices

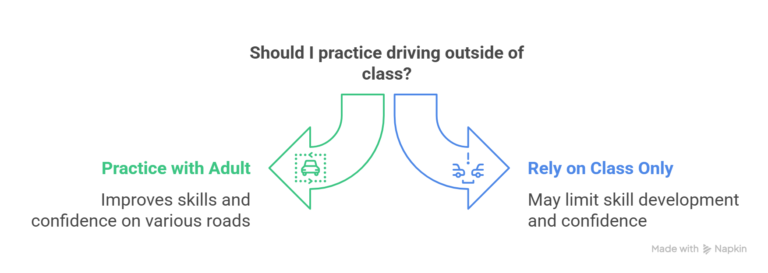

- Scenario analyses simulate the best-case and worst-case outcomes of decisions or dynamic external environments. They depend on artificial intelligence to reduce analysts’ manual effort and accelerate simulations.

- Meanwhile, unstructured data that is abundant over the social networking sites, across the industry magazines, and within the organizational silos cannot be processed with standard data solutions. Consequently, using AI becomes vital. Natural language processing (NLP) models can aid in making sense of unstructured data, while AI can synthesize more relevant reports based on what is found.

- AI and data solutions can capture the core details from regulatory guidelines irrespective of the perplexing vocabulary of many formal documents. Therefore, front-office workers and compliance assurance teams can reduce time spent on interpreting regulatory expectations.

Conclusion

The rise of AI and data analytics advancements is also helpful to investment banking professionals. These new tech marvels aid in handling extensive data volumes for valuation and risk assessment. Predictive analytics, scenario-specific insight exploration, NLP-aided communication improvements, and contextual sentiment recognition are some use cases of AI that modernize how IBs deliver their services. As more investment bankers adapt to innovative AI and data solutions, the industry will have a brighter future of efficient risk identification and more reliable value determination.