Introduction

In the ever-changing banking and finance industry, efficiency and innovation are essential for preserving a competitive edge. One of the most significant transformations in recent years has been the growing adoption of ATM outsourcing services. Traditionally seen as a core in-house function, ATM management is increasingly being delegated to third-party specialists. This shift is not merely about cost-cutting – it’s a strategic move that is revolutionizing how banks operate, deliver services, and engage with customers.

Definition

ATM outsourcing services refer to the practice of delegating the management, maintenance, and operation of automated teller machines (ATMs) to third-party service providers. These services typically include cash management, software updates, hardware maintenance, transaction processing, and compliance with regulatory standards, allowing banks and financial institutions to reduce costs, improve efficiency, and focus on core banking operations.

What Are ATM Outsourcing Services?

ATM outsourcing services involve delegating the ownership, operation, or maintenance of Automated Teller Machines (ATMs) to external service providers. These third-party vendors can handle a variety of functions, including:

- Cash replenishment

- Maintenance and repair

- Security monitoring

- Software upgrades

- Customer support

- Compliance and reporting

Brown Label ATMs are another example of an outsourcing approach in which the vendor manages the infrastructure and operations while the bank’s branding is used. There are also White Label ATMs, entirely managed by third parties under their own brand.

The Driving Forces Behind ATM Outsourcing

Several factors are prompting banks to adopt ATM outsourcing models:

Cost Efficiency:

Maintaining ATM networks is capital intensive. Expenses include security, manpower, compliance, hardware, and software. Outsourcing these operations allows banks to convert fixed costs into variable ones, reducing capital expenditure while improving operational efficiency.

Focus on Core Banking Activities:

By outsourcing non-core functions like ATM operations, banks can concentrate on their primary competencies — customer service, lending, financial advisory, and digital banking innovation. This shift enhances customer experience and improves strategic agility.

Improved Uptime and Performance:

Higher uptime and quicker technical issue resolution are guaranteed by third-party service providers who specialise in ATM operations. This leads to better customer satisfaction as machines are more consistently available and reliable.

Access to the Latest Technology:

Advanced analytics, contactless transactions, biometric authentication, and other innovative technology are frequently implemented first by ATM service providers. Banks can leverage these innovations without having to invest in R&D or infrastructure.

Scalability and Expansion:

Banks can expand their ATM network more readily through outsourcing. Whether entering new markets or managing seasonal surges in demand, third-party providers offer the flexibility to respond quickly without logistical constraints.

Key Benefits for Banks

The transformation enabled by ATM outsourcing is multifaceted. Here’s how it’s redefining banking operations:

Enhanced Customer Experience:

With outsourced services ensuring consistent uptime and the availability of advanced features (e.g., cardless withdrawals, multi-language interfaces), customer satisfaction improves. Service providers also offer around-the-clock technical support, ensuring problems are resolved swiftly.

Regulatory Compliance:

ATM service vendors often provide built-in compliance with industry regulations, from data protection to financial reporting. As a result, banks are relieved of the responsibility of staying current with ever-changing compliance rules.

Security and Fraud Management:

ATM service providers utilize the latest in cybersecurity protocols, real-time surveillance, and anti-skimming technologies. With their expertise and dedicated monitoring, they help minimize fraud and theft, protecting both customers and banks.

Data-Driven Insights:

Modern ATM outsourcing services come with analytics capabilities. Banks can access detailed reports on user behavior, cash flow patterns, and machine performance, enabling smarter decision-making and more targeted service delivery.

Faster Deployment of Innovations:

Third-party vendors can roll out software updates, security patches, and new features across a network of ATMs more rapidly than a bank’s internal IT department. Banks can keep ahead of the competition and satisfy changing client expectations thanks to this agility.

Challenges and Considerations

While ATM outsourcing offers numerous advantages, it also introduces certain risks and challenges that banks must address:

Vendor Dependence:

Over-reliance on third-party vendors can pose risks in terms of service quality, pricing, and business continuity. Clear SLAs (Service Level Agreements) and regular performance reviews are essential.

Data Security and Privacy:

Outsourcing increases the number of stakeholders handling sensitive customer data. It’s vital that banks ensure robust data protection measures and compliance with data privacy regulations such as GDPR or local equivalents.

Brand Control:

When outsourcing, especially with white-label models, banks may lose some control over branding and customer touchpoints. Consistent service quality is crucial to maintaining the brand’s reputation.

Integration with Core Systems:

Seamless integration between outsourced ATMs and the bank’s core banking systems is necessary to deliver real-time updates, transaction transparency, and accurate reporting.

Future Trends of ATM Outsourcing Services Market

Rise of Smart and Multifunctional ATMs:

Outsourced ATMs are expected to evolve into smart kiosks capable of handling complex transactions like account opening, loan applications, and biometric authentication, reducing the need for physical branches.

Increased Adoption of Managed Services:

Banks are shifting toward full-service outsourcing models that include end-to-end management — from installation and maintenance to analytics and customer support — to reduce internal workloads and increase efficiency.

AI and Predictive Maintenance Integration:

Service providers are beginning to implement AI and machine learning for predictive maintenance, cash forecasting, and real-time monitoring, ensuring higher uptime and operational optimization.

Greater Focus on Cybersecurity:

With rising concerns over ATM-related fraud, future outsourcing contracts will emphasize advanced cybersecurity features like real-time fraud detection, encryption technologies, and compliance with global data privacy laws.

Expansion in Emerging Markets:

As financial inclusion becomes a global priority, ATM outsourcing will gain traction in developing regions, enabling banks to extend services to underserved and rural populations at a lower cost.

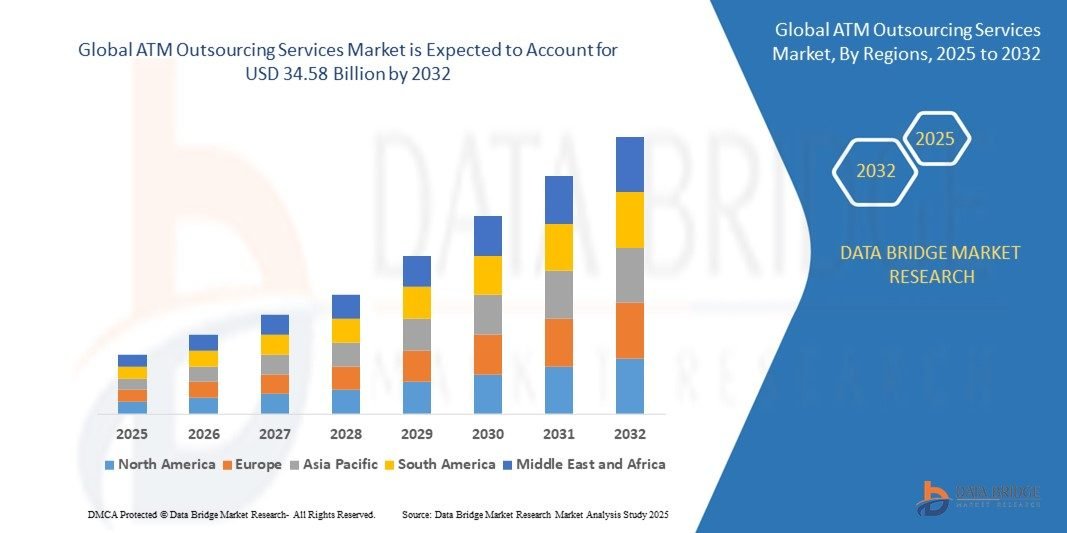

Growth Rate of ATM Outsourcing Services Market

According to Data Bridge Market Research, at a compound annual growth rate (CAGR) of 6.10%, the global ATM outsourcing services market is projected to grow from its 2024 valuation of USD 21.53 billion to USD 34.58 billion by 2032.

Read More: https://www.databridgemarketresearch.com/reports/global-atm-outsourcing-services-market

Conclusion

ATM outsourcing services are no longer just a cost-saving tactic – they are a strategic enabler for modern banking. By delegating ATM operations to expert providers, banks can enhance efficiency, ensure regulatory compliance, deliver superior customer service, and adapt rapidly to market changes.