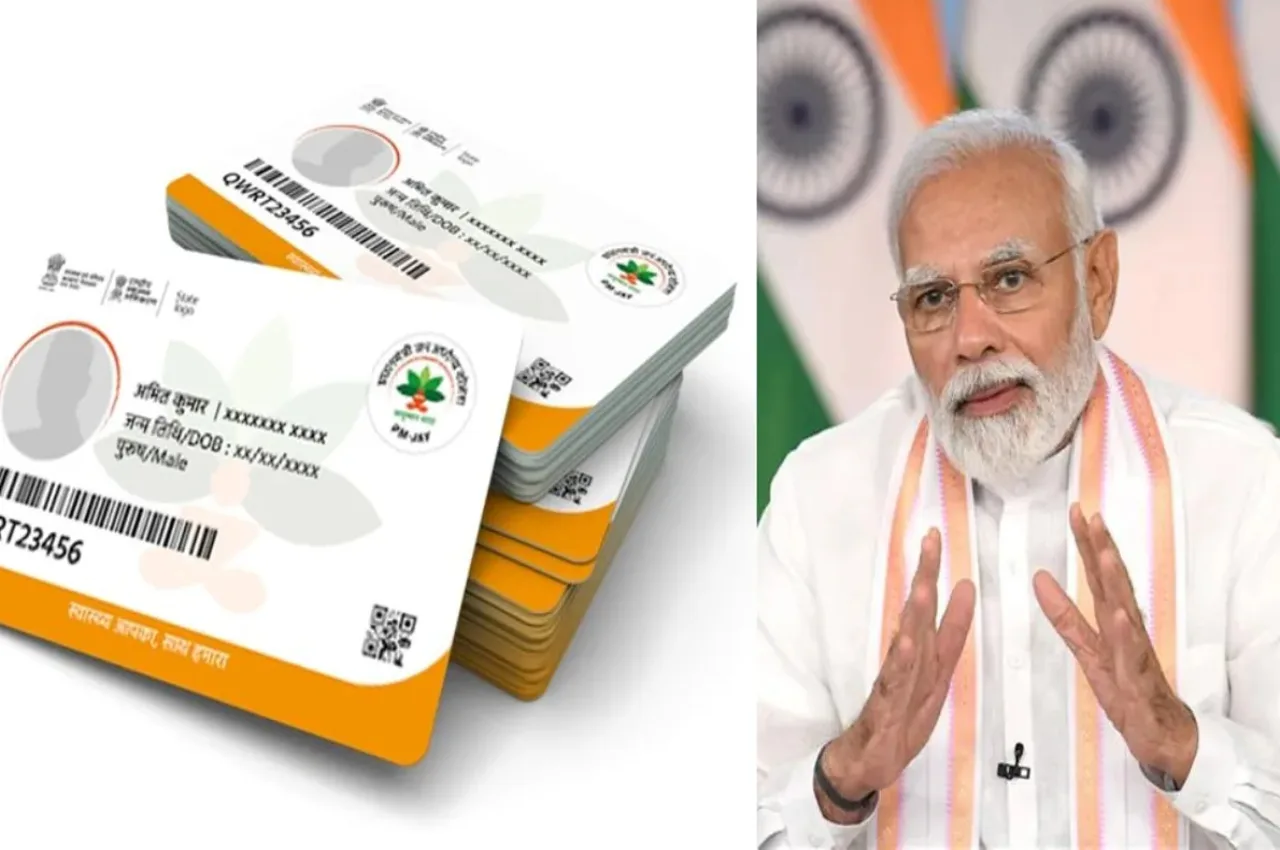

Healthcare expenses in India continue to rise, putting pressure on household savings and family budgets. To address this challenge, the Government of India launched the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (PM-JAY). At the centre of this initiative is the Ayushman card, which provides financial protection by offering families access to quality healthcare without the burden of out-of-pocket costs.

As of 2025, the scheme has expanded to include wider benefits and stronger coverage, making the Ayushman card an essential health safeguard. For many families, completing the Ayushman card download could mean saving lakhs of rupees in treatment costs each year.

Healthcare cover of Rs. 5 lakh per family

The Ayushman card provides coverage of up to Rs. 5 lakh per family annually. This limit applies to both secondary and tertiary care hospitalisation, covering major medical procedures, surgeries, and long-term treatments. For families that might otherwise struggle to arrange large sums of money during emergencies, this cover can be life-changing.

Families listed in SECC database included

Eligibility under PM-JAY is determined using the Socio-Economic Caste Census (SECC) database. Families identified in this database are automatically entitled to benefits, ensuring that healthcare reaches those most in need. By using this framework, the scheme provides targeted support to vulnerable sections of society.

Priority to girl child, women, and senior citizens

A key feature of the Ayushman card is its focus on inclusivity. Priority is given to the girl child, women, and senior citizens, ensuring that these groups—often most affected by lack of access to healthcare—receive necessary protection. This focus on social equity highlights the card’s role in reducing gender and age-based healthcare disparities.

Coverage for secondary and tertiary care

The scheme goes beyond basic medical care to cover specialised treatment. Beneficiaries can use their Ayushman card for procedures such as cardiac surgeries, cancer treatment, orthopaedic operations, and advanced therapies. By including both secondary and tertiary care, the scheme reduces the financial burden of illnesses that typically require expensive interventions.

Pre-existing diseases covered

Unlike many private insurance policies that exclude pre-existing conditions, the Ayushman card covers them from the start. Families with members suffering from chronic diseases such as diabetes, hypertension, or kidney failure can still access cashless treatment. This feature is especially important for senior citizens, who are more likely to face long-term health issues.

Cashless and paperless administration

One of the strongest benefits of the Ayushman card is the cashless and paperless treatment process. Empanelled hospitals directly settle expenses with the scheme administrators, allowing patients to receive care without worrying about upfront payments. Digital systems have also simplified registration and claim procedures, making healthcare access smoother for beneficiaries.

Reduction in out-of-pocket expenditure

Out-of-pocket expenditure is a major reason why medical emergencies push families into debt. With the Ayushman card, most treatment costs are covered under the scheme, significantly reducing household financial strain. Medicines, hospitalisation charges, and diagnostic services are included, leaving very little for families to spend from their savings.

Private sector participation

To meet public health goals, the scheme has encouraged participation from private hospitals alongside government facilities. This partnership expands access to quality treatment and ensures beneficiaries can choose from a wider network of hospitals. By involving private players, the scheme brings world-class care within reach of economically weaker families.

Improved quality of life

By covering major illnesses, ensuring timely care, and reducing financial stress, the Ayushman card directly improves the quality of life for millions. Families no longer need to delay treatments due to cost concerns, and patients can focus on recovery rather than worrying about bills. This benefit, though not always measured in numbers, is among the most valuable outcomes of the scheme.

Broadening of the health insurance network

Another long-term impact of the Ayushman card is the expansion of India’s health insurance ecosystem. By covering millions of families and integrating private sector participation, the scheme is strengthening the overall healthcare network in the country. This broader reach contributes to better infrastructure, improved facilities, and more equitable access to medical services.

How to download the Ayushman card

Eligible families can generate their card through the official PM-JAY portal or by visiting a Common Service Centre (CSC). The process typically involves Aadhaar verification and linking details with the SECC database. Once registration is complete, the Ayushman card download is available in digital format, which can be stored on a smartphone for easy access during hospital visits.

Conclusion

The Ayushman card is more than just a health card—it is a lifeline for millions of Indian families. With benefits such as Rs. 5 lakh annual coverage, pre-existing disease inclusion, cashless administration, and nationwide hospital access, it protects families from the devastating financial effects of serious illness.

In 2025, the scheme’s focus on women, senior citizens, and vulnerable groups continues to make it one of the largest social security programmes in the world. By broadening the healthcare network and reducing out-of-pocket expenses, it has the power to save families lakhs of rupees while improving their overall well-being.

For those eligible, completing the Ayushman card download is a crucial step towards securing health and financial peace of mind.