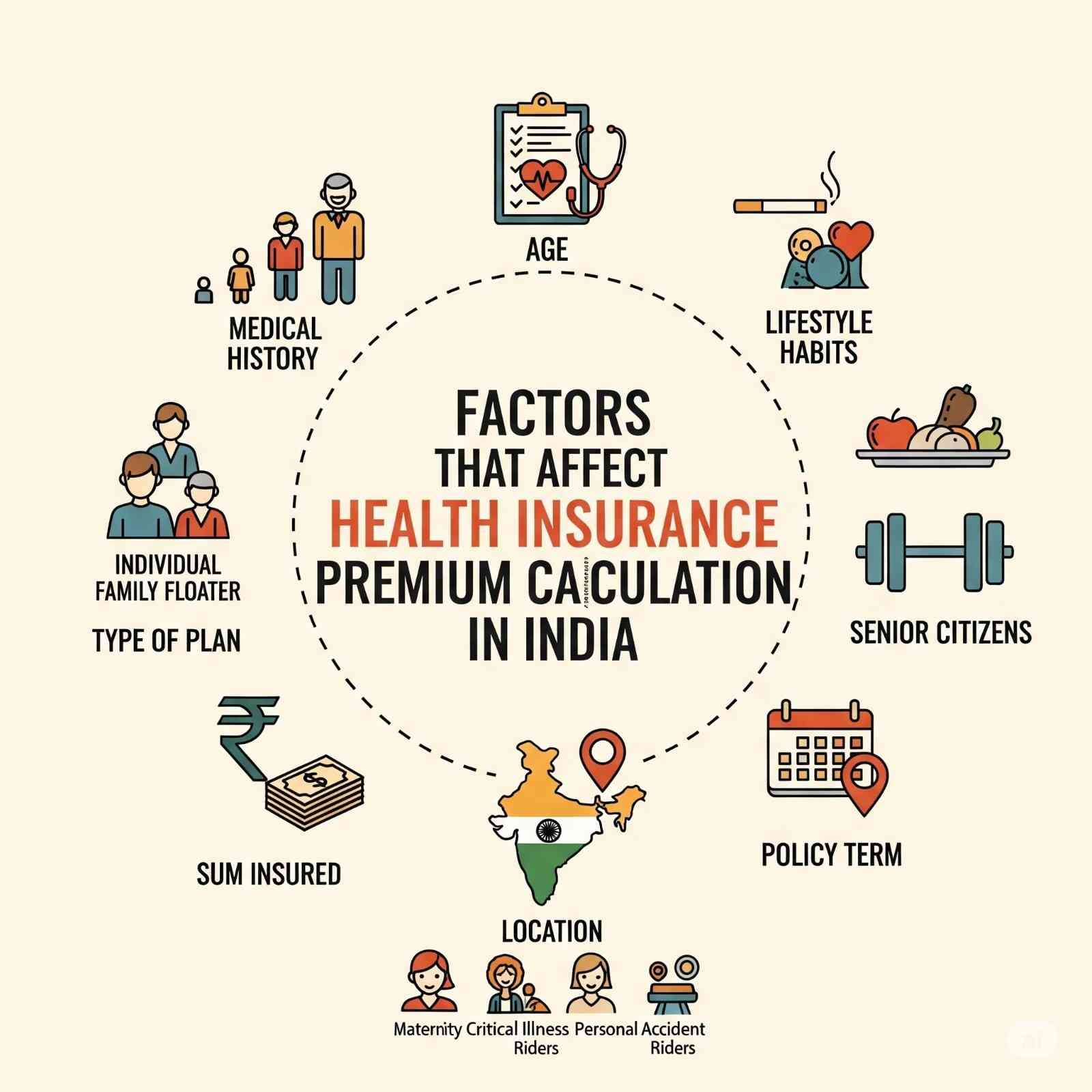

Understanding how health insurance calculate works can feel like deciphering a secret code. Your premium isn’t just a number, it reflects a complex mix of personal factors, risk assessments, and market dynamics. Sounds confusing? You’re not alone. But proper health insurance planning makes it simple: by knowing the factors that drive premium costs, you can choose the health insurance best plan suited to your health needs and budget.

In India, where medical inflation soars and lifestyle diseases fuel escalating claims, you can no longer rely on guesswork. This guide lays out the most important factors used by insurers to compute your health insurance cost, showing you how to make informed choices that benefit you over the long term.

Age: The Key Driver of Health Insurance Premium Rates

Age is the single most influential determinant when insurers health insurance calculate your premium. Younger adults, especially those in their 20s and 30s, enjoy significantly lower rates because they’re statistically less likely to file claims. But as you cross into higher age bands, premiums can jump 30-60% per bracket. Insurers see older adults as higher risk due to common conditions like hypertension, diabetes, and cardiovascular disease.

Tip: Buy early, even if you’re healthy today, premiums will rise sharply later.

Sum Insured & Type of Plan

The sum insured determines the maximum amount payable for medical costs. Naturally, higher coverage means more cost for the insurer, hence a higher premium. Similarly, plan type matters. Individual plans often cost less than family floater plans. Advanced plans with maternity or critical illness riders further push premiums up.

Smart move: Choose a sum insured that meets rising healthcare costs.

Pre‑Existing Conditions & Medical History

Insurers scrutinise existing health problems, like diabetes, thyroid issues, heart disease, or asthma, under pre-existing conditions travel insurance logic. In India, medical history can trigger higher premiums or waiting periods (1–4 years), and in some cases, outright exclusions.

Accurate medical declarations are essential. Hiding or underreporting can lead to claim denials or policy cancellation down the line. Transparency ensures pricing reflects true risk and you pay only what’s required.

Lifestyle: Habits That Impact Premiums

Smoking, alcohol use, and even sedentary lifestyles affect how insurers calculate your risk, and hence your premium. Smokers can pay nearly double the premium of non-smokers of the same age. High BMI (Body Mass Index) is another red flag, since it correlates with conditions like diabetes or hypertension. Insurers may charge more or offer discounts for healthier habits.

Pro tip: staying active and maintaining a healthy BMI can reduce premium costs.

Family Medical History

If an immediate family (parents, grandparents) has a history of chronic illnesses like cancer, heart issues, or Alzheimer’s, insurers may view you as higher risk. That means a higher premium, even if you’re healthy now. Disclosing full family history is part of common health insurance planning and ensures you’re not caught off-guard when you make a claim.

Geographic Location & Pollution Risk

Health insurance premium calculators also factor in your city or geographic location. Tier‑1 metro cities (like Delhi, Mumbai, Bengaluru) often command 10–20% higher premiums due to elevated medical costs. Insurers in New Delhi may even charge additional premiums due to rising respiratory disease claims linked to air pollution.

What it means: Living in a polluted metro could cost you more, even if your personal health is perfect.

Gender & Marital Status

Gender influences premium rates: women in childbearing years often pay higher premiums due to potential maternity claims, while older women may pay less than men due to longevity patterns. Married individuals may find family floater plans more economical. Insurers may also offer tax benefits on such policies under Section 80D.

Occupation & High‑Risk Activities

Your job and hobbies shape risk profiles. A construction worker or chemical handler may pay more due to higher injury risk, while office-based professionals enjoy lower premiums. Similarly, if you engage in adventure activities like scuba diving or trekking, expect additional charges.

Claim History & No‑Claim Bonus

Insurers reward low-claim consumers with No Claim Bonus (NCB), discounts on renewal premiums for each claim-less year. Conversely, frequent claims raise your risk profile and your premiums.

Add-Ons & Riders

Add‑On options, like maternity cover, critical illness, or room upgrade enhance protection but also raise premium costs. IRDAI caps rider-related premium hikes at 30% of base premium. Choose add‑ons only when essential.

Policy Duration & Renewal Terms

Choosing longer-term policies (2–3 years) can lock in premium rates and offer discounts. Shorter tenures may cost more. On renewal, premiums rise due to age and medical inflation, even if you’ve never claimed. IRDAI limits how much premium can increase annually for certain age groups.

Medical Inflation & Regulatory Oversight

India’s medical inflation often outpaces general inflation, averaging 10–12% annually. Policy costs rise to match this escalation. The government is now tightening oversight of claims portals to curb hospital overcharging to protect policyholders and moderate premium growth.

Practical Table: Health Insurance Premium Factors

Factor | Impact |

Age | Higher age = higher premium due to increased risk |

Sum Insured & Plan Type | Larger coverage and family floater plans cost more |

Pre‑Existing Conditions | Conditions prior to policy raise premiums or waiting periods |

Lifestyle & BMI | Smoking, obesity increase risk profiles |

Gender & Family History | Women in maternity years, family illness history matter |

Location | Higher city costs or pollution zones raise premiums |

Occupation & Hobbies | High-risk jobs or adventure hobbies cost extra |

Claim History / NCB | No-claim rewards vs. higher premium for frequent claims |

Riders/Add‑Ons | Enhanced benefits = higher cost |

Policy Tenure | Longer plans = price lock; renewals adjust upwards |

Medical Inflation & Regulation | Rising healthcare costs drive annual premium increases |

Conclusion: Master Your Health Insurance Planning

When choosing your health insurance best plan, understand that premiums are not arbitrary, they are calculated based on real-world risk factors: age, medical history, location, lifestyle, and policy features. Smart health insurance planning means evaluating your health profile and future needs to select a policy that balances affordability with adequate coverage.

If you’re looking for a trustworthy insurer in India with transparent underwriting and options tailored to individual risk factors, including pre-existing condition considerations, Niva Bupa health insurance stands out. They offer policies with clear terms for declared health issues, flexible sum insured options, add‑on riders, and reputed customer service.

By choosing Niva Bupa, you get access to medically-sound plans that align with your health profile and a partner that helps you understand what drives your premium so you can plan better for the future.

Take control: compare factors, declare your health honestly, and select the health insurance best plan that fits your life.